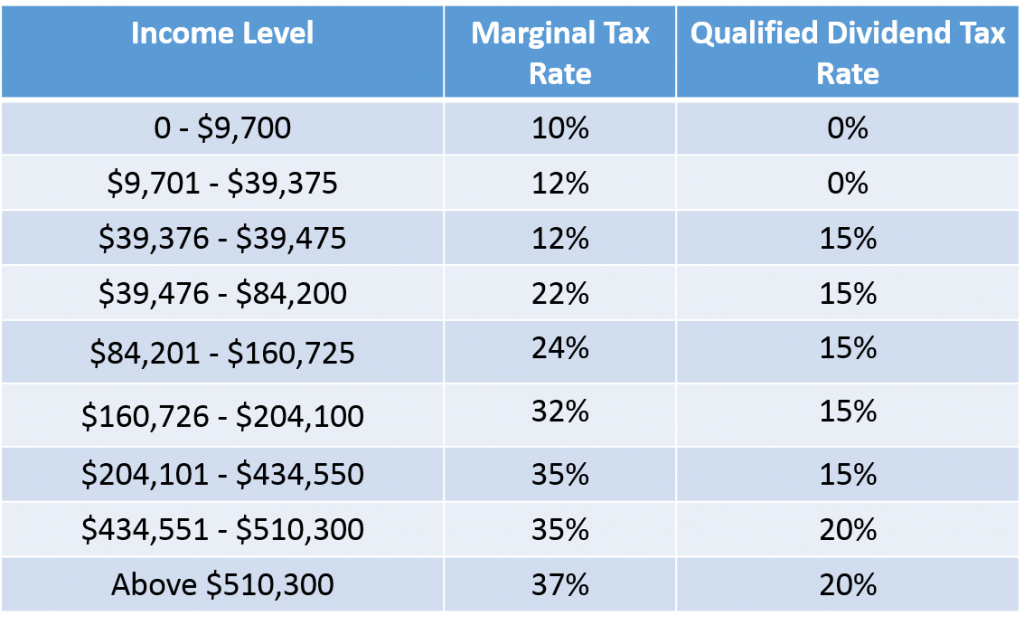

2025 Dividend Tax Rates. 37% for incomes over $609,350. What are the qualified dividend tax rates?

These rates are influenced by your tax bracket, which is determined. For example, the dividend tax rate for 2025 was as follows:

Tax Basics WES, Denmark and the united kingdom follow, at 42 percent and 39.4. Also healthy is the 11% upside reflected in analysts' average target price.

Tax rates for the 2025 year of assessment Just One Lap, For example, the dividend tax rate for 2025 was as follows: 2025 irs tax refund dates.

Changes to UK Tax in 2025 Holborn Assets, Learn how and why certain dividends are taxed more than others. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate ).

How much you'll save with the dividend tax credit, Here’s a look at the rates at which qualified dividends are taxed in. 20% tax on £17,000 of wages.

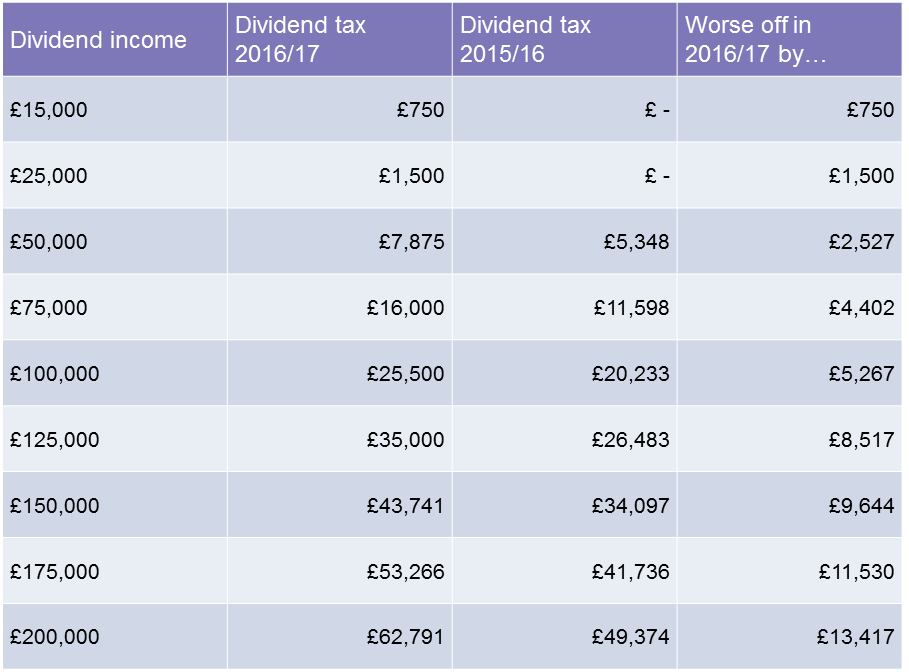

Beware! Your dividend tax rate is changing, here's what you need to know, What are the qualified dividend tax rates? At autumn budget 2025, the government announced that the rate of income tax applicable to dividend income would increase by 1.25 percentage point to 8.75% for.

Tax Information Every US citizen Working in Canada Must Know, Dividend tax is the income tax levied on the dividend payments received by investors from their stock holdings. The rates are 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Count OnHome, Qualified dividends are taxed at 0%, 15% or 20% depending on taxable income and filing status. Understand how dividend income is taxed and stay informed about the dividend tax rates.

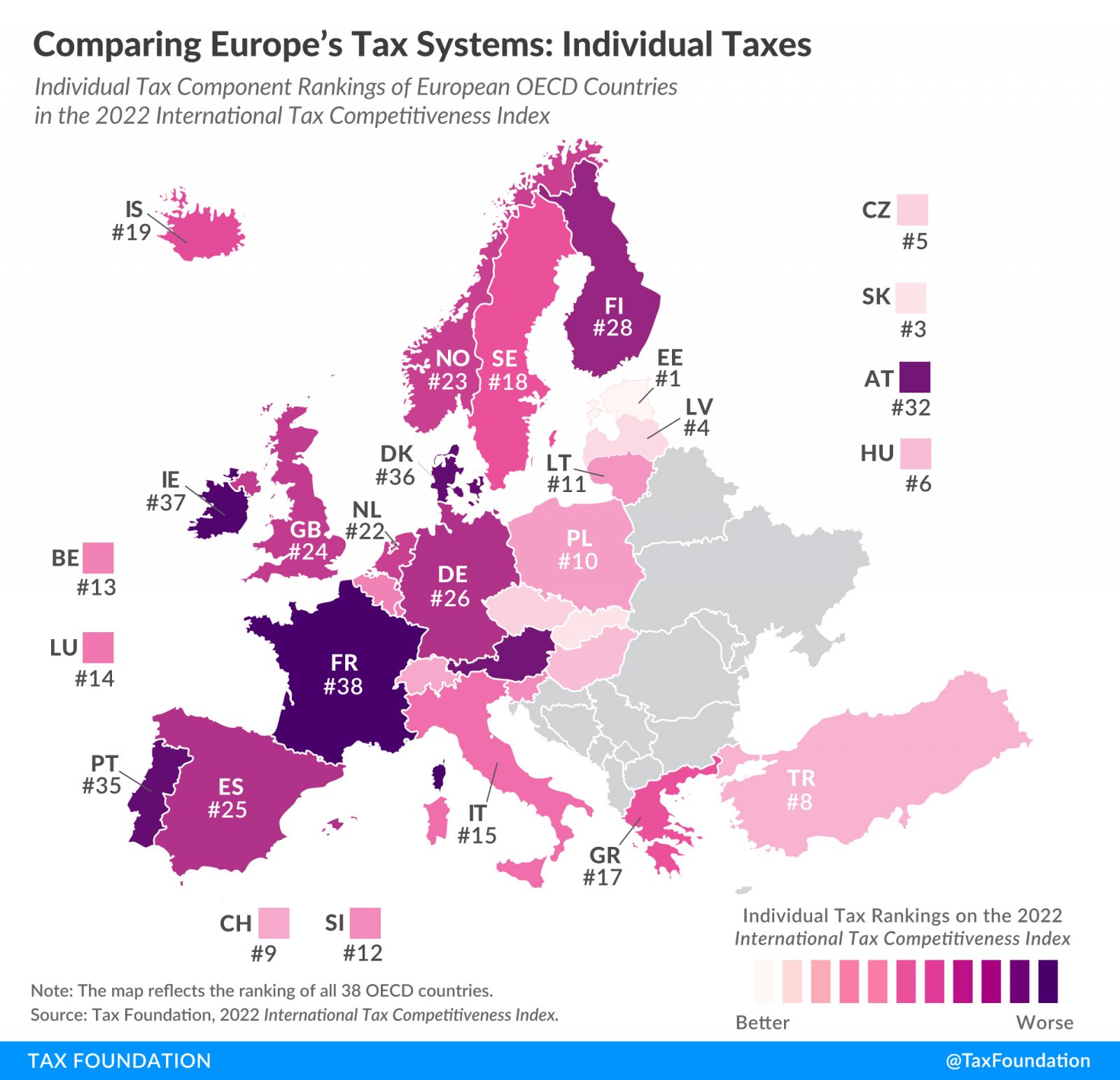

Top Personal Tax Rates in Europe Tax Foundation, Earlier, the maharatna psu announced an interim dividend of rs 4.5 per equity share of rs 10. The thresholds can change by year.

Tax Rates Sunset in 2026 and Why That Matters Barber Financial Group, No tax on £2,000 of. Dividend tax is the income tax levied on the dividend payments received by investors from their stock holdings.